Logistic regression, LDA, QDA - Part 2

Dr. D’Agostino McGowan

LDA

- Go to the sta-363-s20 GitHub organization and search for

appex-02-lda - Clone this repository into RStudio Cloud

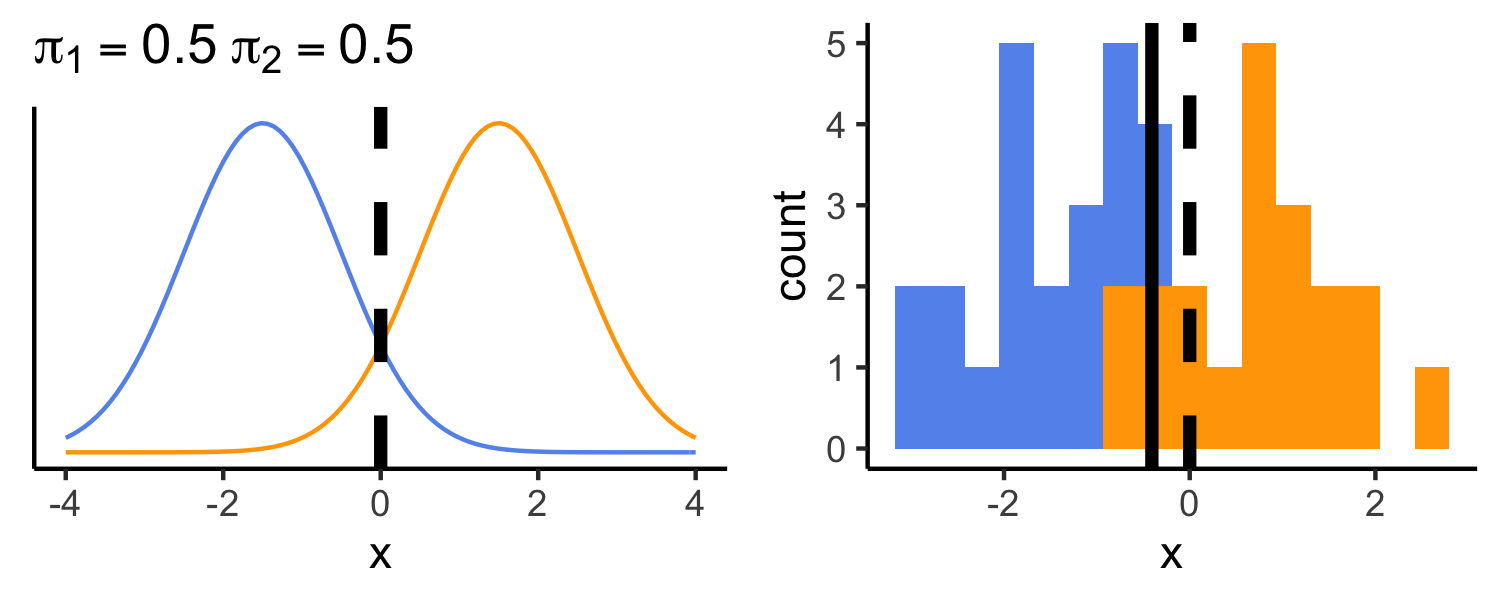

- μ1=−1.5

- μ2=1.5

- π1=π2=0.5

- σ2=1

- μ1=−1.5

- μ2=1.5

- π1=π2=0.5

- σ2=1

- typically we don't know the true parameters, we just use our training data to estimate them

Estimating parameters

^πk=nkn

Estimating parameters

^πk=nkn ^μk=1nk∑i:yi=kxi

Estimating parameters

^πk=nkn ^μk=1nk∑i:yi=kxi

^σ2=1n−KK∑k=1∑i:yi=k(xi−^μk)2=K∑k=1nk−1n−K^σ2k

Estimating parameters

^πk=nkn ^μk=1nk∑i:yi=kxi

^σ2=1n−KK∑k=1∑i:yi=k(xi−^μk)2=K∑k=1nk−1n−K^σ2k

^σ2k=1nk−1∑i:yi=k(xi−^μk)2

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n))## # A tibble: 3 x 3## y n pi## <dbl> <int> <dbl>## 1 1 5 0.333## 2 2 5 0.333## 3 3 5 0.333Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n))## # A tibble: 3 x 3## y n pi## <dbl> <int> <dbl>## 1 1 5 0.333## 2 2 5 0.333## 3 3 5 0.333group_by(): do calculations on groups

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n))## # A tibble: 3 x 3## y n pi## <dbl> <int> <dbl>## 1 1 5 0.333## 2 2 5 0.333## 3 3 5 0.333group_by(): do calculations on groupssummarise(): reduce variables to values

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n))## # A tibble: 3 x 3## y n pi## <dbl> <int> <dbl>## 1 1 5 0.333## 2 2 5 0.333## 3 3 5 0.333group_by(): do calculations on groupssummarise(): reduce variables to valuesmutate(): add new variables

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n))group_by(): do calculations on groupssummarise(): reduce variables to valuesmutate(): add new variables

How do we pull πk out into their own R object?

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

df %>% group_by(y) %>% summarise(n = n()) %>% mutate(pi = n / sum(n)) %>% pull(pi) -> piHow do we pull πk out into their own R object?

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^πk=nkn

pi## [1] 0.3333333 0.3333333 0.3333333How do we pull πk out into their own R object?

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^μk=1nk∑i:yi=kxi

df %>% group_by(y) %>% summarise(mu = mean(x))## # A tibble: 3 x 2## y mu## <dbl> <dbl>## 1 1 -1.46## 2 2 1.5 ## 3 3 3.54Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^μk=1nk∑i:yi=kxi

df %>% group_by(y) %>% summarise(mu = mean(x)) %>% pull(mu) -> muEstimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^σ2=K∑k=1nk−1n−K^σ2k

df %>% group_by(y) %>% summarise(var_k = var(x), n = n()) %>% mutate(v = ((n - 1) / (sum(n) - 3)) * var_k) %>% summarise(sigma_sq = sum(v))## # A tibble: 1 x 1## sigma_sq## <dbl>## 1 1.47Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^σ2=K∑k=1nk−1n−K^σ2k

df %>% group_by(y) %>% summarise(var_k = var(x), n = n()) %>% mutate(v = ((n - 1) / (sum(n) - 3)) * var_k) %>% summarise(sigma_sq = sum(v)) %>% pull(sigma_sq) -> sigma_sqEstimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

δk(x)=xμkσ2−μ2k2σ2+log(πk)

- Let's predict the class for x=2

x <- 2x * (mu / sigma_sq) - mu^2 / (2 * sigma_sq) + log(pi)## [1] -3.8155857 0.1795063 -0.5436021Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

δk(x)=xμkσ2−μ2k2σ2+log(πk)

- Let's predict the class for x=2

x <- 2x * (mu / sigma_sq) - mu^2 / (2 * sigma_sq) + log(pi)## [1] -3.8155857 0.1795063 -0.5436021Which class should we give this point?

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

δk(x)=xμkσ2−μ2k2σ2+log(πk)

- Let's predict the class for x=6

x <- 6x * (mu / sigma_sq) - mu^2 / (2 * sigma_sq) + log(pi)## [1] -7.796499 4.269486 9.108750Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

δk(x)=xμkσ2−μ2k2σ2+log(πk)

- Let's predict the class for x=6

x <- 6x * (mu / sigma_sq) - mu^2 / (2 * sigma_sq) + log(pi)## [1] -7.796499 4.269486 9.108750Which class should we give this point?

From the discriminant score to probabilities

We can turn ^δk(x) into estimates for class probabilities

From the discriminant score to probabilities

We can turn ^δk(x) into estimates for class probabilities

^P(Y=k|X=x)=e^δk(x)∑Kl=1e^δl(x)

From the discriminant score to probabilities

We can turn ^δk(x) into estimates for class probabilities

^P(Y=k|X=x)=e^δk(x)∑Kl=1e^δl(x)

- Classifying the largest ^δk(x) is the same as classifying to the class with the largest ^P(Y=k|X=x)

From the discriminant score to probabilities

We can turn ^δk(x) into estimates for class probabilities

^P(Y=k|X=x)=e^δk(x)∑Kl=1e^δl(x)

- Classifying the largest ^δk(x) is the same as classifying to the class with the largest ^P(Y=k|X=x)

- For K=2:

- classify to 2 if ^P(Y=2|X=x)≥0.5

- classify to 1 otherwise

Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

^P(Y=k|X=x)=e^δk(x)∑Kl=1e^δl(x)

- Let's get the posterior probability of each class for x=6

x <- 6d <- x * (mu / sigma_sq) - mu^2 / (2 * sigma_sq) + log(pi)exp(d) / sum(exp(d))## [1] 4.515655e-08 7.850755e-03 9.921492e-01Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

- There is a function to do this in R called

lda()in the MASS package

library(MASS)model <- lda(y ~ x, data = df)Estimating parameters (in R!)

| x | -1.6 | 0.2 | -0.9 | -2.0 | -3.0 | 1.9 | 1.2 | 2.2 | 2.7 | -0.5 | 1.8 | 3.3 | 5.0 | 3.4 | 4.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

- There is a function to do this in R called

lda()in the MASS package

library(MASS) model <- lda(y ~ x, data = df)predict(model, newdata = data.frame(x = 6))## $class## [1] 3## Levels: 1 2 3## ## $posterior## 1 2 3## 1 4.515655e-08 0.007850755 0.9921492## ## $x## LD1## 1 3.968523 LDA

- Go to the sta-363-s20 GitHub organization and search for

appex-02-lda - Clone this repository into RStudio Cloud

- Complete the exercises

- Knit, Commit, Push

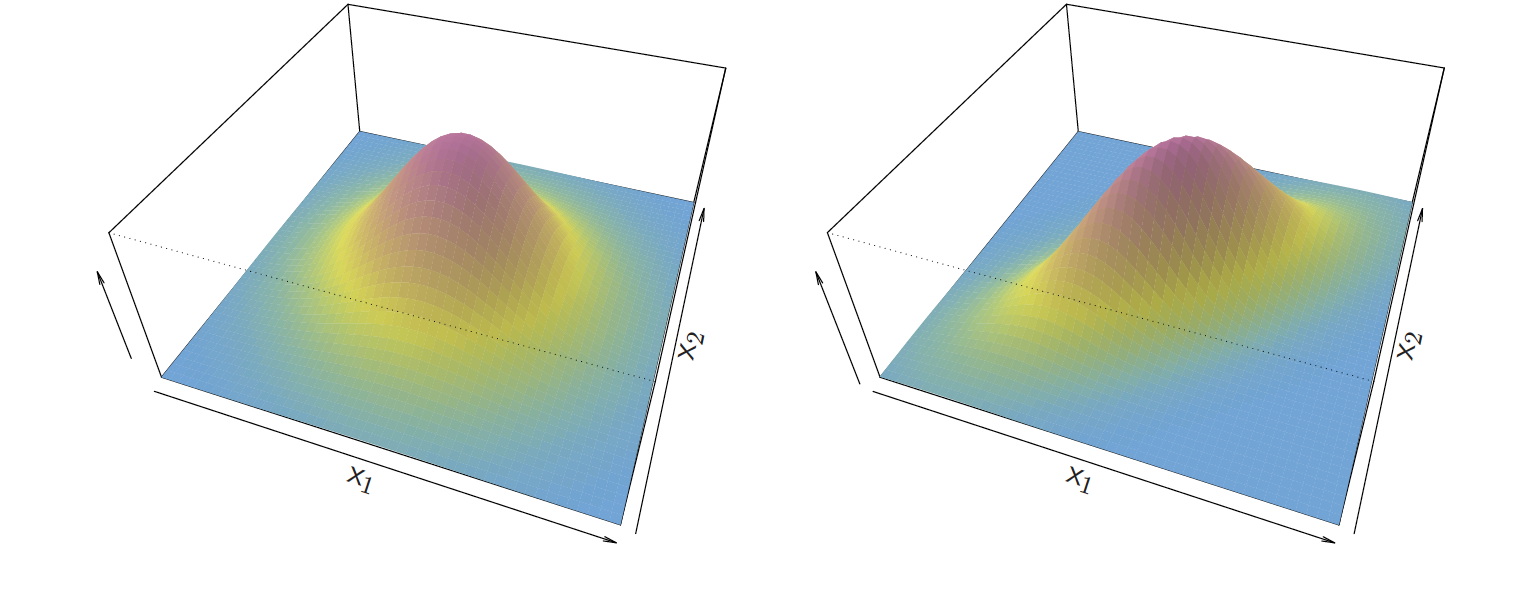

Linear discriminant analysis p>1

- When p>1 the density takes on the multivariate normal density

f(x)=1(2π)p/2|Σ|1/2e−12(x−μ)TΣ−1(x−μ)

Linear discriminant analysis p>1

- The discriminant function is now

δk(x)=xTΣ−1μk−12μTkΣ−1μk+logπk

- This is still a linear function!

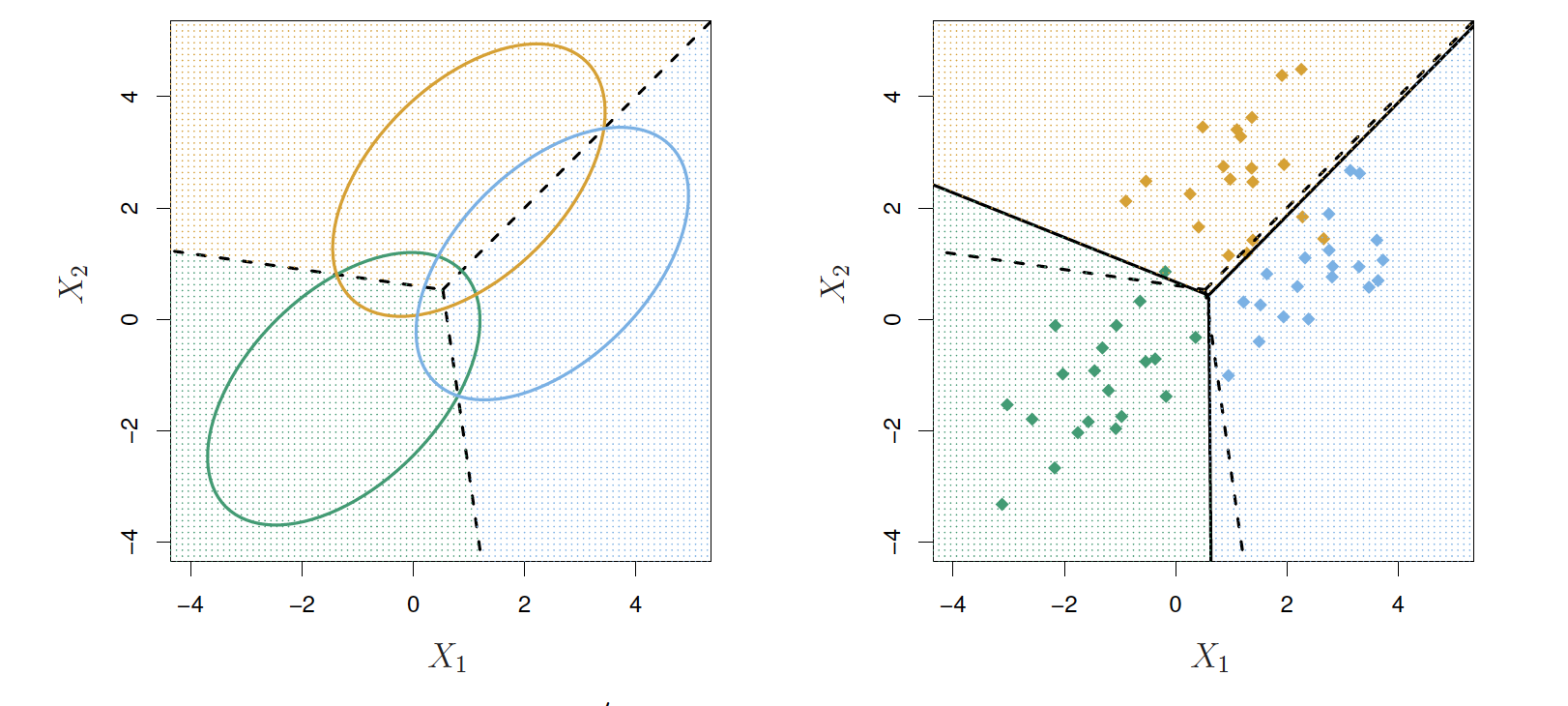

Example p=2, K=3

- Here π1=π2=π3=1/3

- The dashed lines the Bayes decision boundaries

- If they were known, they would yield the fewest misclassification errors, among all possible classifiers.

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

What is the misclassification rate?

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

What is the misclassification rate?

- 23+25210000 errors - 2.75% misclassification

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

What is the misclassification rate?

- 23+25210000 errors - 2.75% misclassification

Since this is training error what is a possible concern?

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

What is the misclassification rate?

- 23+25210000 errors - 2.75% misclassification

Since this is training error what is a possible concern?

- This could be overfit

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

- 23+25210000 errors - 2.75% misclassification

This could be overfit- Since we have a large n and small p ( n=10,000, p=4 ) we aren't too worried about overfitting

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

- 23+25210000 errors - 2.75% misclassification

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

- 23+25210000 errors - 2.75% misclassification

What would the error rate be if we classified to the prior,

Nodefault?

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

- 23+25210000 errors - 2.75% misclassification

What would the error rate be if we classified to the prior,

Nodefault? - 333/10000 - 3.33%

LDA on Credit Data

| True Default (No) | True Default (Yes) | Total | |

|---|---|---|---|

| Predicted Default (No) | 9644 | 252 | 9895 |

| Predicted Default (Yes) | 23 | 81 | 104 |

| Total | 9667 | 333 | 10000 |

- 23+25210000 errors - 2.75% misclassification

- Since we have a large n and small p ( n=10,000, p=4 ) we aren't too worried about overfitting

- Of the true

No's, we make 23/9667=0.2% errors; of the trueYes's, we make 252/333=75.7% errors!

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

What is the false positive rate in the Credit Default example?

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

What is the false positive rate in the Credit Default example?

- 0.2%

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

What is the false positive rate in the Credit Default example?

What is the false negative rate in the Credit Default example?

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

What is the false positive rate in the Credit Default example?

- 0.2%

What is the false negative rate in the Credit Default example?

- 75.7%

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

- The Credit Default table was created by predicting the

Yesclass if

^P(Default|Balance, Student)≥0.5

Types of errors

- False positive rate: The fraction of truly negative that are classified as positive

- False negative rate: The fraction of truly positive that are classified as negative

- The Credit Default table was created by predicting the

Yesclass if

^P(Default|Balance, Student)≥0.5 We can change the two error rates by changing the *threshold from 0.5 to some other number between 0 and 1

^P(Default|Balance, Student)≥threshold

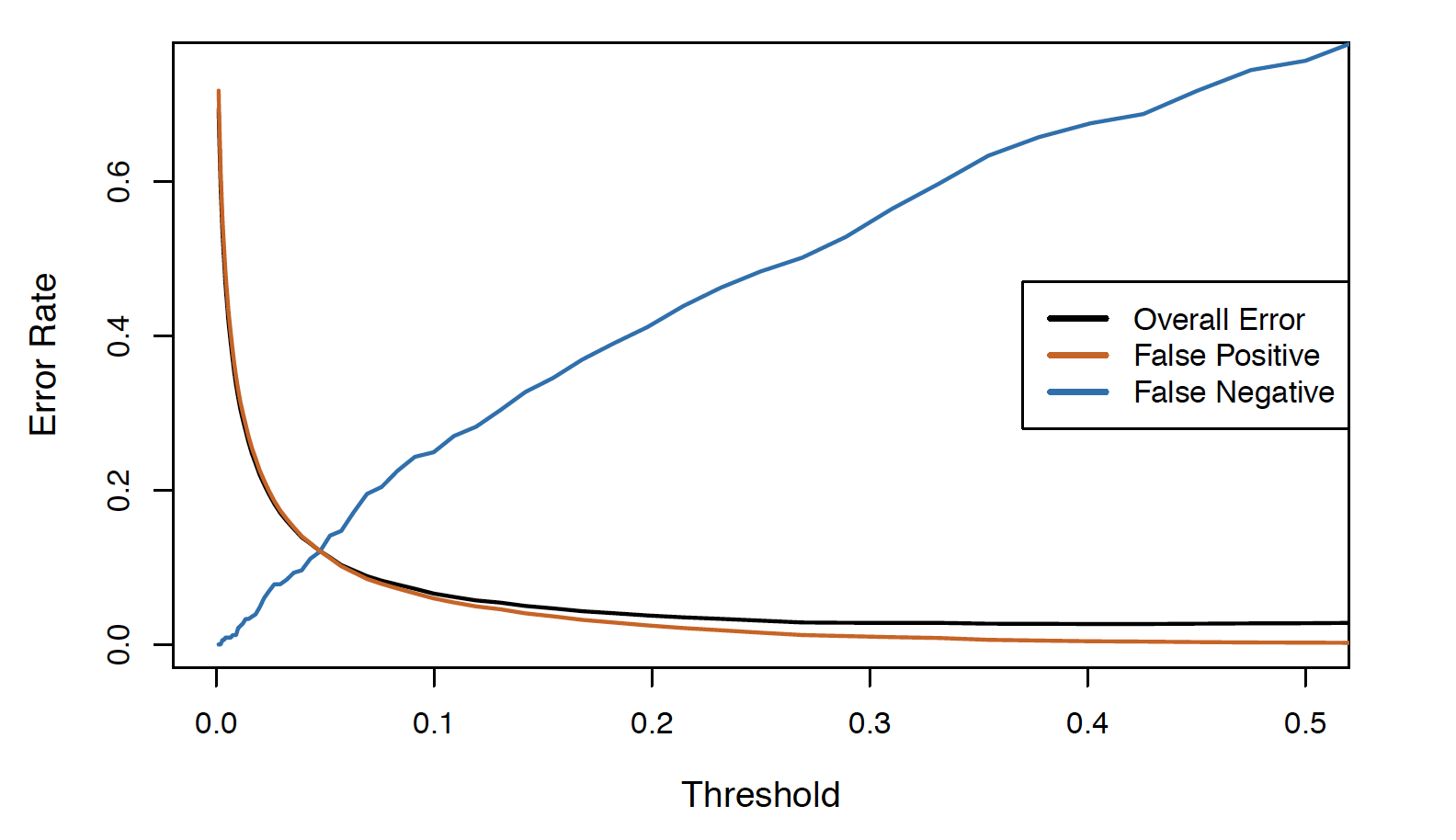

Varying the threshold

- To reduce the false negative rate we may want the threshold to be 0.1 or less

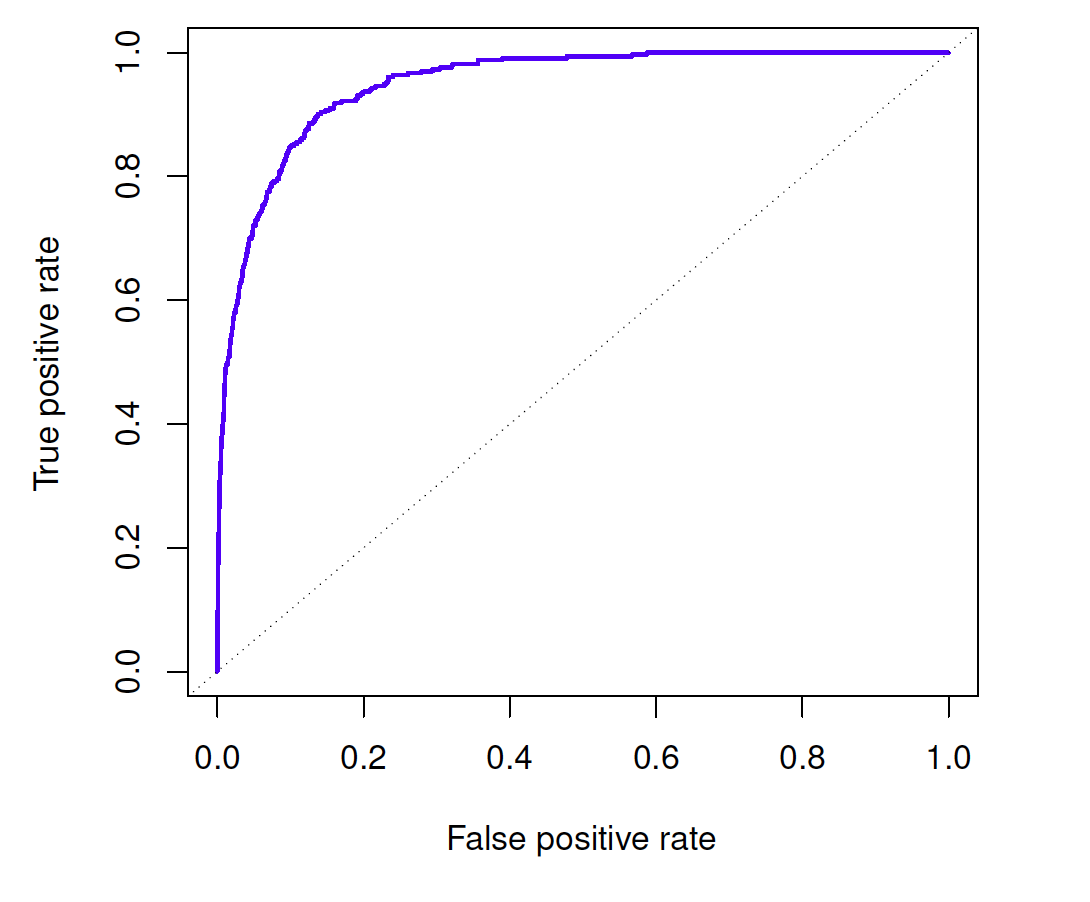

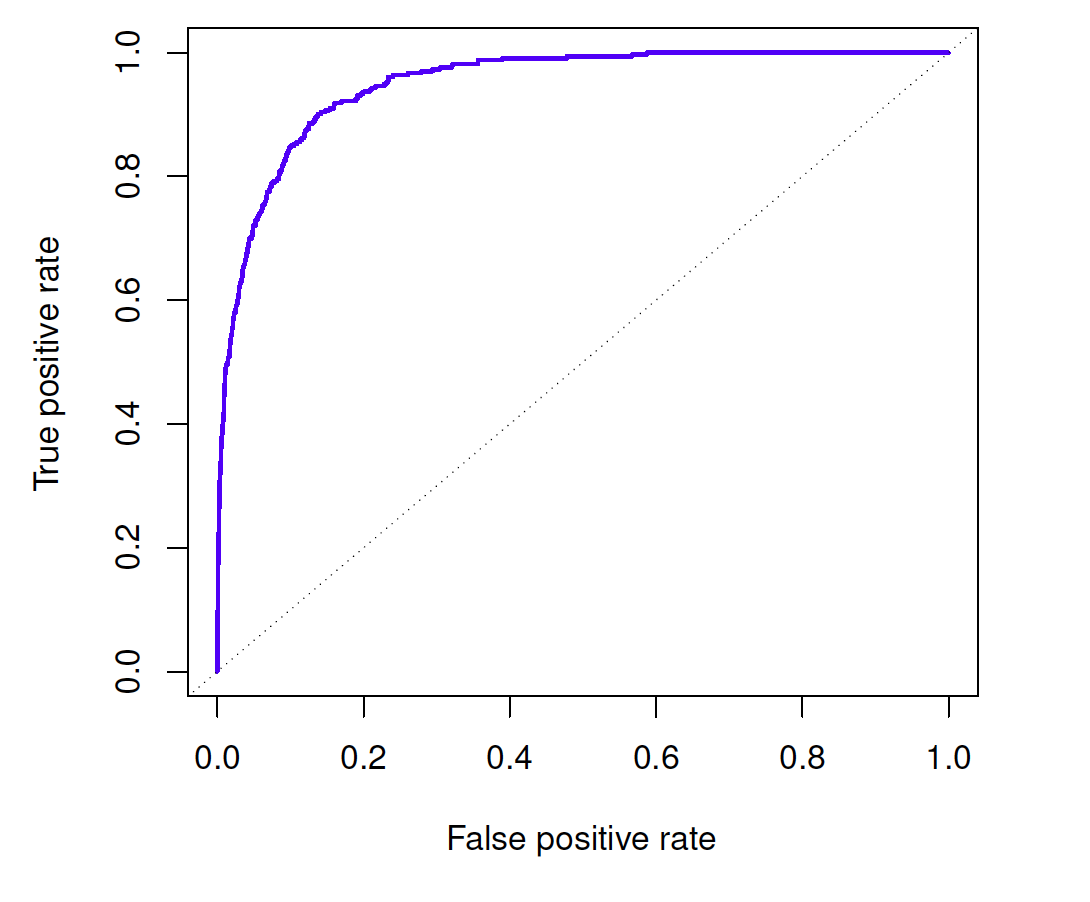

ROC

- A receiver operating characteristic (ROC) curve looks at both simultaneously

- The area under the ROC curve (AUC) is sometimes a metric for performance

ROC

- A receiver operating characteristic (ROC) curve looks at both simultaneously

- The area under the ROC curve (AUC) is sometimes a metric for performance

Which do you think is better, higher or lower AUC?

Let's see it in R

library(MASS)model <- lda(default ~ balance + student + income, data = Default)- Use the

lda()function in R from the MASS package

Let's see it in R

library(MASS)model <- lda(default ~ balance + student + income, data = Default)predictions <- predict(model)- Use the

lda()function in R from theMASSpackage - Get the predicted classes along with posterior probabilities using the

predict()function

Let's see it in R

library(MASS)model <- lda(default ~ balance + student + income, data = Default)predictions <- predict(model)Default %>% mutate(predicted_class = predictions$class)- Use the

lda()function in R from theMASSpackage - Get the predicted classes along with posterior probabilities using the

predict()function - Add the predicted class using the

mutate()function

Let's see it in R

library(MASS)model <- lda(default ~ balance + student + income, data = Default)predictions <- predict(model)Default %>% mutate(predicted_class = predictions$class) %>% summarise(fpr = sum(default == "No" & predicted_class == "Yes") / sum(default == "No"), fnr = sum(default == "Yes" & predicted_class == "No") / sum(default == "Yes"))## fpr fnr## 1 0.002275784 0.7627628- Use the

summarise()function to add the false positive and false negative rates

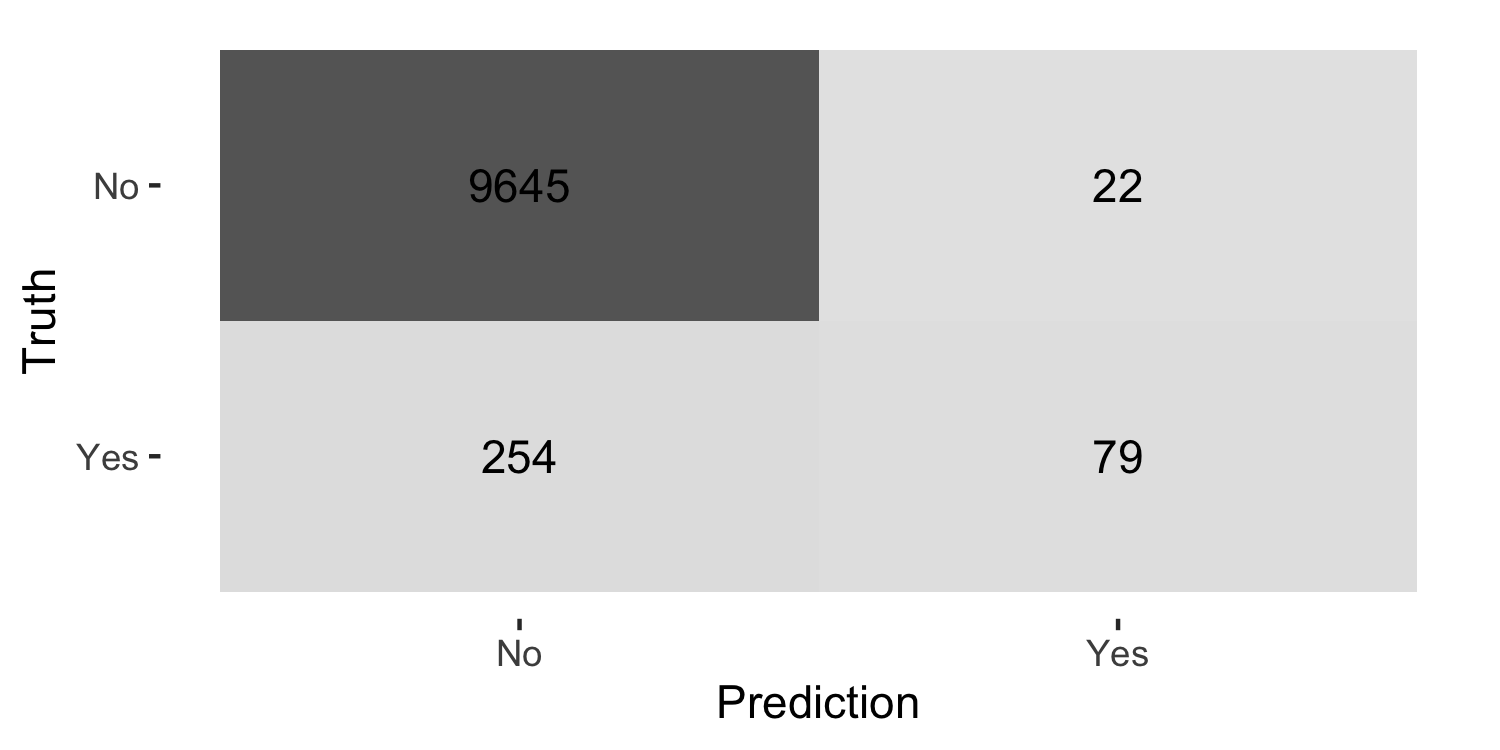

Let's see it in R

library(MASS)library(tidymodels)model <- lda(default ~ balance + student + income, data = Default)predictions <- predict(model)Default %>% mutate(predicted_class = predictions$class) %>% conf_mat(default, predicted_class) %>% autoplot(type = "heatmap")

Let's see it in R

conf_mat()expects your outcome to be a factor variable

library(MASS)library(tidymodels)model <- lda(default ~ balance + student + income, data = Default)predictions <- predict(model)Default %>% mutate(predicted_class = predictions$class, default = as.factor(default)) %>% conf_mat(default, predicted_class) %>% autoplot(type = "heatmap")